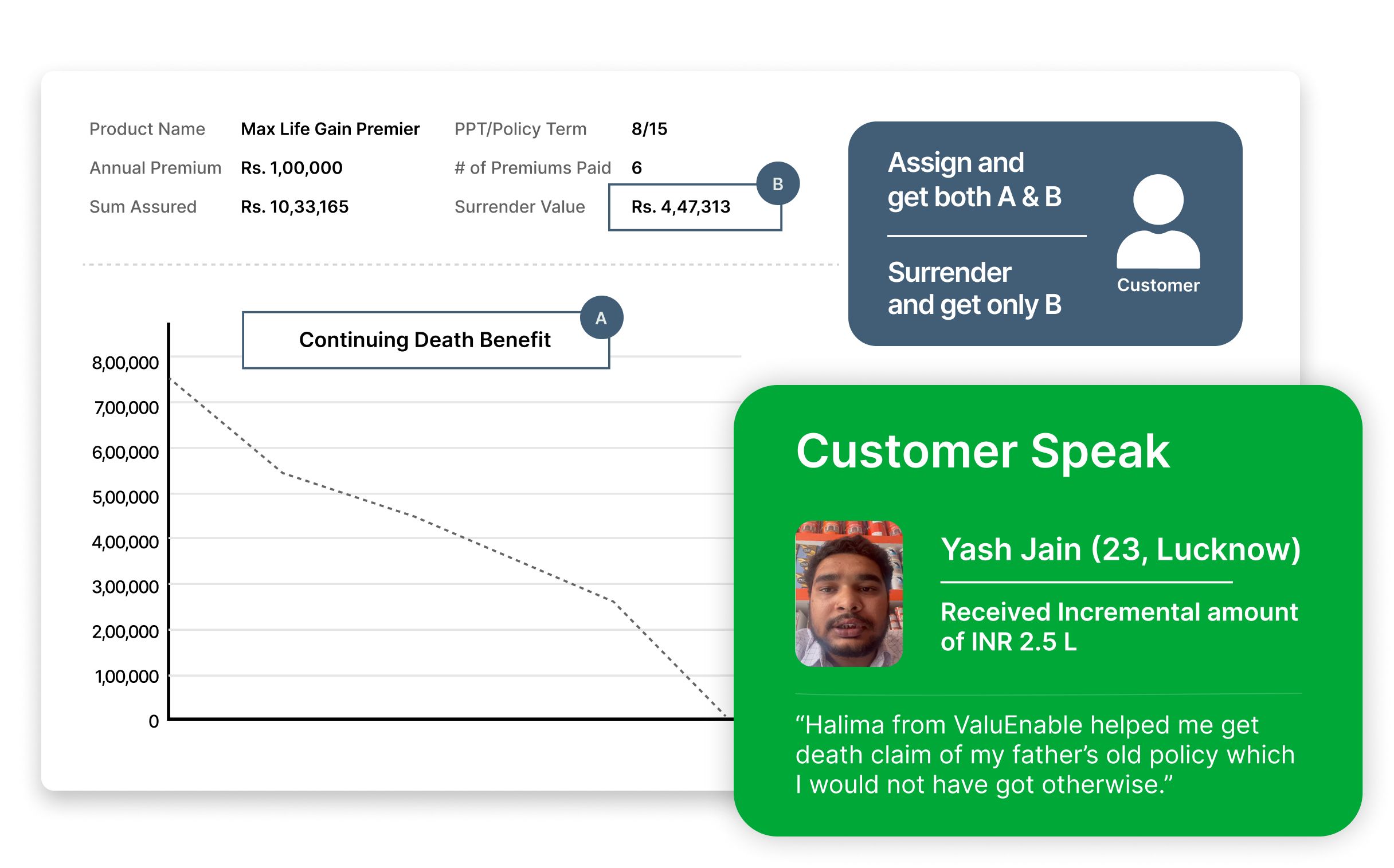

Unlock Liquidity Without

Losing Life Cover

Instant cash + continued protection

Better alternative than Surrendering

Complete Digital process backed by Insurers

A solution where everyone wins — Investors, Insurers & Policyholders.

Instant

cash + continued protection

Instant

cash + continued protection  Better

alternative than Surrendering

Better

alternative than Surrendering Complete

Digital process backed by Insurers

Complete

Digital process backed by Insurers

Premium

continuation & reduced lapse rates

Premium

continuation & reduced lapse rates

Improved

Embedded Value

Improved

Embedded Value Compliant with Sec 38, Insurance Act

Compliant with Sec 38, Insurance Act

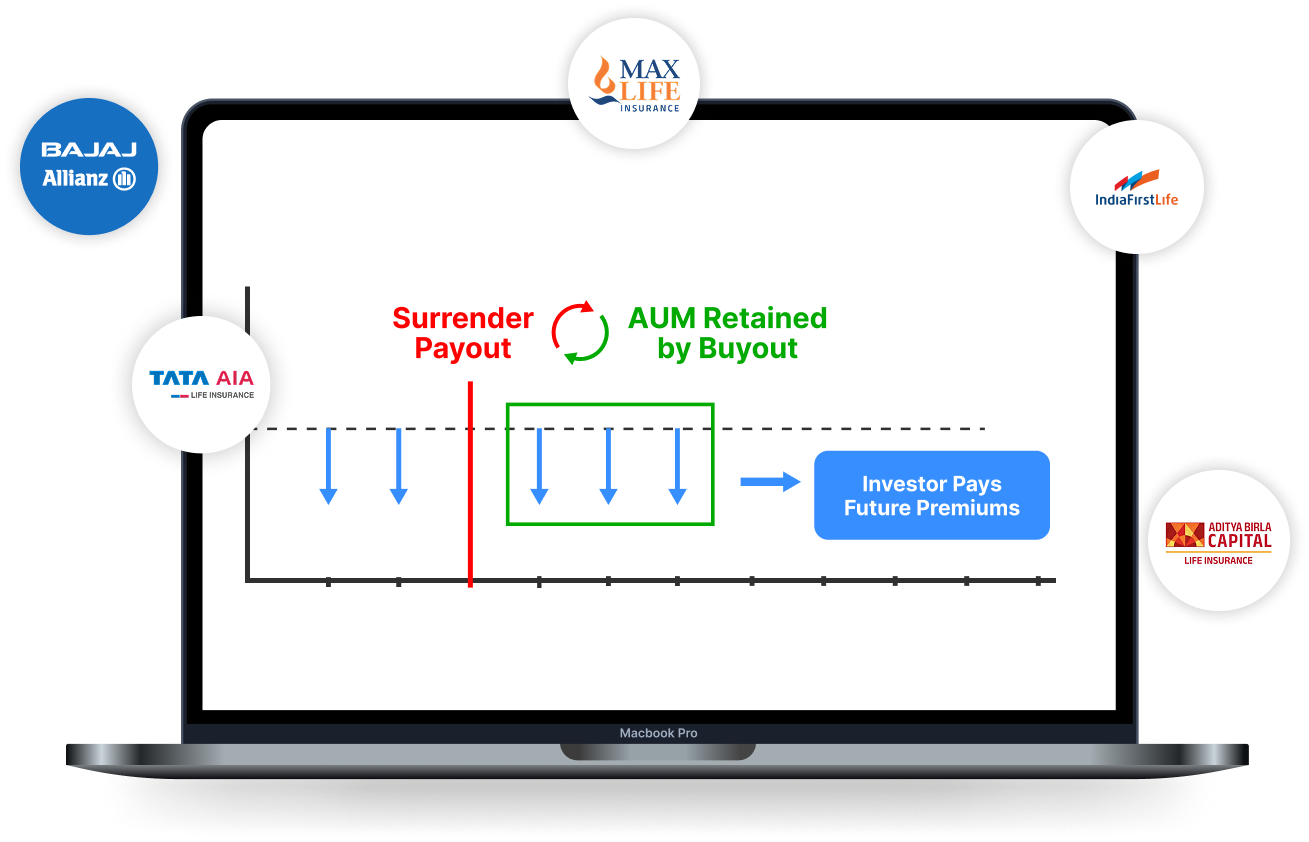

Security

backed by Surrendering Policies

Security

backed by Surrendering Policies 7.5%-8%

Tax-Free IRR

7.5%-8%

Tax-Free IRR Multiple

Ticket-size, Insurance Companies & Tenure Options

Multiple

Ticket-size, Insurance Companies & Tenure Options

A solution where everyone wins —

Investors, Insurers & Policyholders.

Instant cash + continued protection

Better alternative than Surrendering

Complete Digital process backed by Insurers

Premium continuation & reduced lapse rates

Improved Embedded Value

Compliant with Sec 38, Insurance Act

Security backed by Surrendering Policies

7.5-8% Tax-Free IRR

Multiple Ticket-size, Insurance Companies & Tenure Options

Hear what industry leaders say about ValuEnable.

“Secondary insurance policies offer great risk-return profile and ValuEnable platform is making it easily accessible.”

Trusted partners to grow your wealth smarter.